1. Introduction

This paper literally focuses on the topic which is “challenges of managing an organisation change with the help of strategic project plan” which involves the merger or acquisition among the two organisation that is Northern and Southern bank. It is found that the Northern bank acquired Southern bank by paying a price of $1.5 billion in stock to successfully complete the process of such acquisition. Detailed stakeholders’ engagement in such a transaction are analysed alongside the impact on the overall organisation culture. The current position of the banks is identified alongside the key drivers that involves both internally and externally based on strategic change are duly mentioned in the conducted study. The impact on political, social, technological, legal and economic factors are depicted in the report due to the merger that took place among the two companies.

2. Discussion

2.1 Analysis of current position of the banks

Generally, it is significant to note that merger and acquisition are risky propositions where most of the experienced people from both the organisation which are Northern and Southern are involved in such a deal. The current position of both the banks are analysed with help of the key drivers that leads to such success of this organisational change are highlighted in this segment (Kato and Schoenberg 2014, p. 335). Some of the key drivers which are initiated for the purpose of ensuring a success to such organisational change are discussed and highlighted accordingly.

These are some of the key drivers which the combined organisation must execute properly to be a stand out in the market (Saha et al. 2018). It is considered as some of the strategic changes which has the chance to lead towards success in the long run.

2.2 Evaluation of business decisions involved with such merger

The critical evaluation of the merger that took place between Northern bank and Southern bank are enumerated based on certain parameters which are duly taken into consideration in the conducted analysis. The purpose of Northern bank to acquire Southern bank is to determine the capital growth and boost in the entire organisation. By taking a look at the pre-acquisition profiles of both the organisation, the necessary interpretation regarding positive aspects of such acquisition is highlighted accordingly.

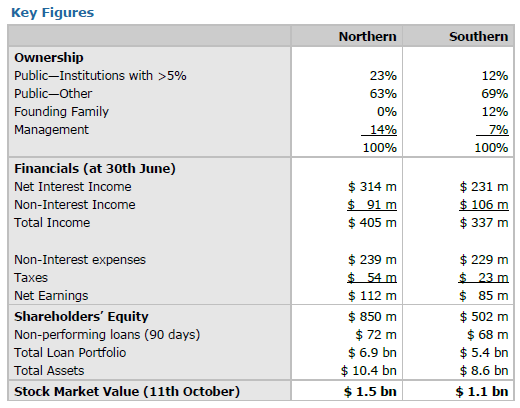

From the chart of Fig. 1, it can be said that the stock market value of Southern bank was quite high which means that merger among the two companies were a boost of capital and ownership. In comparison to the financial strengths, Northern bank were much capable as its ownership value stands on $1.5 billion before such acquisition took place. It seems that both the banks had a huge margin of revenue which acts as a plus point to meet the strategic financial growth objective after the merger is formed. Alongside it can also be said that the total loan portfolio and assets of the organisation is huge in comparison to the non-performing loan.

Now, from a strategic decision-making process, it is quite important to analyse the some of the key aspects that includes the opportunity decision, crisis decision and problem decision.

2.3 Map and rank of stakeholders

Effective stakeholders mapping involves requires a collaborative process of research and discussion from multiple perspective which is only possible by determine the list of potential stakeholders involved in such merger or acquisition among the two organisations (van der Sluis et al. 2019, p. 458). The list of key stakeholders from both Northern and Southern bank are identified in first place which are enumerated as follows.

Northern bank key stakeholders list:

Southern bank key stakeholders list

Key external stakeholders list

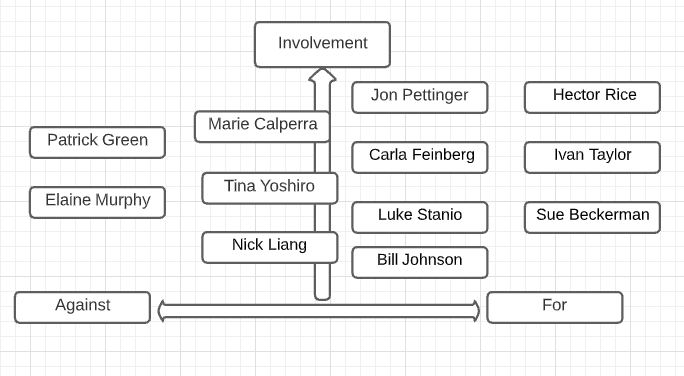

All the key stakeholders of both the organisation alongside some of the external business stakeholders are duly identified in a detailed manner which will eventually ease the process of mapping (Krupa et al. 2018, p. 136). The mapping of all the key stakeholders is enumerated in the following diagram presented accordingly.

From Fig. 2, it can be interpreted that the stakeholders are mapped accordingly which is reasoned based on their interest on such acquisition proposal of Northern bank. It is found that seven key stakeholders including both the banks as well as the external parties are interested in such decision change related to business acquisition and merger. On the other three stakeholders ae involved in such deal and quite supports the acquisition deal as well. But two key stakeholders are in doubt in such deal and is duly mapped under the against radar. The chart concludes that it is highlight likely that the Northern bank acquiring Southern bank due to firm interest of most of the key stakeholder’s interest in such deal to happen. Basically, the two CEO’s of both the banks Jon and Sue are actually interested to ensure the success of such acquisition deal.

Now it is quite significant to ascertain the rationale, political and emotional factors of the stakeholders that will create an impact on the business strategy are enumerated in the following manner.

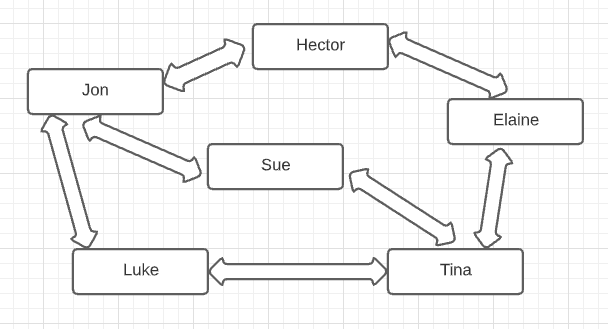

It is significant to note that all the business strategies must be aligned in relation to these three discussed factors. The network analysis based on the function of the stakeholders are designed with the help of the following diagram presented accordingly.

In Fig. 3, it is significant to note that only the key stakeholders who fits to create a strong network link in terms of functional and organisational point of view are only considered while creating the network analysis. Jon and Sue are the CEO of each bank where they share or deal with the aspects related to same line of business. Luke and Tina being the head of the retail banking takes care of the HQ and branch process in their respective organisation. Elaine and Hector are both HR directors in their respective organisation where both the HR directors tries to stick with concern of the employees. All of them are interrelated as most of the key stakeholders depicted in the network analysis are basically from the same organisation. All of these selected key stakeholders shown in network analysis hold immense power in their own departments are quite master to take care of the necessary aspects as well. The acquisition is highly a favourable circumstance for the Northern bank as the stakeholders with their power will be able to taking such initiative or decision for the overall success of the combined organisation.

2.4 Stakeholders engagement strategy

Based on the above analysis it can be interpreted that stakeholder’s engagement in such activity plays a significant role in enhancing value of stocks after the merger (Boaz, A., Hanney et al. 2018, p. 9). In that case, it is significant to ensure that the shareholders of Northern bank approve the acquisition which will automatically reduce the resistance. The main tactics of the Northern bank is to emphasize on the shareholders so that they continue to demand the gain of change. The organisation would also take into consideration regarding the synergies which has been developed in result to such acquisition. Next it is important for the stakeholders be concerned about the employees’ job where they must assure that most of them actually retain their position as few branches will be closed. The tactic which must be adopted by the stakeholders to ensure that the employees get used to with the changes where it is important to reduce their anxiety through the process of constant and effective communication with them (Awotunde et al. 2020, p. 311). It is a fact that anxiety arrives when people actually stay for a long period of time by being unknown about the circumstances due to which they will be affected and the manner in which it will take place. In that case the stakeholders must provide enough information to them by thorough analysis so that they develop a mindset in terms of being adaptable to changes.

In this particular acquisition deal, there will be a need to enhance capacity for change by deducing the internal mechanism process. On the contrary it will help the company to respond regarding complaints of the employees alongside review the entire fact within a shorter period of time. As part of business integration, the stakeholders must consider the problems of the employees alongside accommodate their emotional outburst as natural method of declaring bad news. In that case, the best option is to assist mangers explore all the possible options or risks pertaining from such merger (Chang and Cho 2017, p. 232). Alongside it is significant to consider them in a decision-making process for the purpose of ensuring that their contribution is valued and that will definitely lead towards success of such acquisition deal among Northern and Southern bank. Apart from that all the major customers of the organisation will be alarmed gradually alongside they will be accommodating into new products if under certain circumstances the customised product found to be scrapped at once. The engagement from the Sunrise Pension Fund stakeholder must be considered as a most significant one as this stakeholder is unlikely to consider any of redundancy in the merger or acquisition that takes place among the two organisations. The combined firm after the acquisition will put emphasis on the gains that are likely going to be appear from the reduced number of branches alongside retention of the best performers. All the communication and activities adopted by the key stakeholders must be monitored and analyse in such a manner so that nothing goes out of the context or plan. On the contrary it can be interpreted that a push and pull communication is said to be quite attractive as it helps to switch interaction among the stakeholders and further works better where the network among the stakeholder is strong which is depicted in the conducted study (Besta et al. 2017, p. 93).

2.5 Risk of change and evaluation of resource

Evaluation of resources

It is quite a fact that the human resource practices of Northern bank are much better than that of Southern bank. Hence in that case after the acquisition deal is done the practices of Northern bank’s practices will replace Southern banks. Elaine Bolta who is the HR Director of Southern bank’s and Hector Rice of Northern bank’s would be quite excited to know who is likely to be the HR director after the merger. It is significant to note that Elaine Bolta has been in his position for a short period of time and is unlikely for a new role in the combined organisation. Hector Rise on the other hand has been quite contributory in terms of creating a better overall human resource practices in Northern bank. The employees of Southern bank who will be retained after the merger requires to sign new contracts with Northern bank that will further be aligned with their individual grades.

Risk of change

The retained employees of Southern bank are mostly affected by the change. Salaries of those employees in that case will be affected which is further assigned to grades in respect to their fixed salaries. Hence it can be interpreted that it is better as employees of Southern bank performing the same responsibilities are going to be issued with the same salary and grade. Sometimes it might act as a discouraging moment for top performers of the organisation. In that case to make the top performers of Southern bank satisfied it is required to promote them or rewarding them by utilising a different approach. Implementing some of this change to the people will help to solve risk that exist within the organisation.

It is significant to note that the bonus scheme of Southern bank employees will be changed. The declaration of bonus in that case will be based on individual performance rather than considering the overall profitability of the bank. This further varies on different situation or circumstances and each approach does have its own advantages. Rewarding employees with the business profitability portion helps to enhance teamwork performance but it becomes difficult to separate the poor performers in comparison to that of top performers within the organisation. The human resource must focus on individual performance of the employees and bonuses will be issued that particularly encourages all the employees in terms of enhancing their productivity and take it to the next level. However, it might result to an increase in individualism that might act as a threat to overall performance of the organisation.

All the retained employees of Southern bank will be availed for a low-interest loan as previously it was beyond the reach make it possible at the time of their business operation. Alongside the employees will be provided the benefit of corporate expense cards for certain cost which are actually incurred at the time of business operation. In usual circumstances, the refund process seemed to be the only option left for Southern bank. For the Southern bank employees’, the pension contributions will become voluntary in nature. This further indicates that they are required to utilize part of their salaries for the purpose of pension contributions. Further this only signifies that all employees can make contribution to a certain extent, that also includes those employees who contributed less than 2 years in the firm.2.6 Summarization

The lesson which is learned from the above evaluation and analysis of the merger it can be interpreted that consulting the stakeholders for the purpose of finalizing the execution plan of the merger with the help of various evaluation. In the method planning at a particular stage, effective integration plan helps to make the key adjustments which is aligned with the critics and further based on requirement of the stakeholders. It is quite difficult to convince all the stakeholders to let the merger deal happen successfully where it simply depends on the choice of the stakeholders regarding acceptance of the critics. The case of Northern bank acquisition deal with the Southern bank, will be a mere success as most of the key stakeholders are actually interested to ensure that the deal is a success. Another key lesson which is learned is that focus might not be a best option when it comes to consider the revenue growth and price saving mechanism. It is important to identify, analyse and convince only the influencing stakeholders who wants to proceed with the plan for the purpose of dealing with business opinions. Type and way of communication alongside the frequency of such communication level plays a significant role while convincing key stakeholders to let the deal be a breakthrough towards overall business growth and success in the long run.

3. Conclusion

Adopting the best strategy is the key to make the merger deal a great success in the future where it is required to help the employees of Southern Bank by eliminating past from the present. It is quite significant to make them understand that they are integrated into the practices of the Northern bank as Southern bank has been acquired by the Northern bank. Basically, it is required to put a lot of importance on the grades which will offer growth opportunities for the top performers in terms promoting the deserving ones in the next stage. The lesson which is also learned that employee empowerment is an option which is required to for the new combined organisation to focus on. Further it is quite important to allow the employees of Southern bank to provide them time so that they become used to the terms and condition of the merged organisation. Effective internal communication and network will gradually help the overall merged organisation to stand competitive in the external or changed business environment.

4. Reference List

Awotunde, J.B, Ayo, F.E, Ogundokun, R.O, Matiluko, O.E and Adeniyi, E.A 2020, July, ‘Investigating the Roles of Effective Communication Among Stakeholders in Collaborative Software Development Projects’. In International Conference on Computational Science and Its Applications (pp. 311-319). Springer, Cham. https://doi.org/10.1007/978-3-030-58817-5_24

Besta, M, Podstawski, M, Groner, L, Solomonik, E and Hoefler, T 2017, June, ‘To push or to pull: On reducing communication and synchronization in graph computations’. In Proceedings of the 26th International Symposium on High-Performance Parallel and Distributed Computing (pp. 93-104). https://doi.org/10.1145/3078597.3078616

Boaventura, J.M.G, Bosse, D.A, de Mascena, K.M.C and Sarturi, G 2020, ‘Value distribution to stakeholders: The influence of stakeholder power and strategic importance in public firms’. Long Range Planning, vol. 53, no. 2, p.101883. https://doi.org/10.1016/j.lrp.2019.05.003

Boaz, A, Hanney, S, Borst, R, O’Shea, A and Kok, M 2018, ‘How to engage stakeholders in research: design principles to support improvement’. Health Research Policy and Systems, vol. 16, no. 1, pp.1-9. https://doi.org/10.1186/s12961-018-0337-6

Boling, J.R, Mayo, D.T and Helms, M.M 2017, ‘Complementarity merger as a driver of change and growth in higher education’. Journal of Organizational Change Management. https://doi.org/10.1108/JOCM-02-2016-0036

Chang, Y.B and Cho, W 2017, ‘The risk implications of mergers and acquisitions with information technology firms’. Journal of Management Information Systems, vol. 34, no. 1, pp.232-267. https://doi.org/10.1080/07421222.2017.1297641

Dubihlela, J and Nqala, L 2017, ‘Internal controls systems and the risk performance characterizing small and medium manufacturing firms in the Cape Metropole’. International journal of business and management studies, vol. 9, no. 2, pp.87-103.

Farrell, J and Shapiro, C 2000, ‘Scale economies and synergies in horizontal merger analysis’. Antitrust LJ, vol. 68, p.685. https://heinonline.org/HOL/LandingPage?handle=hein.journals/antil68&div=46&id=&page=

Kato, J and Schoenberg, R 2014, ‘The impact of post-merger integration on the customer–supplier relationship’. Industrial Marketing Management, vol. 43, no. 2, pp.335-345. https://doi.org/10.1016/j.indmarman.2013.10.001

Krupa, M, Cenek, M, Powell, J and Trammell, E.J 2018, ‘Mapping the stakeholders: Using social network analysis to increase the legitimacy and transparency of participatory scenario planning’. Society & Natural Resources, vol. 31, no. 1, pp.136-141. https://doi.org/10.1080/08941920.2017.1376140

McCann, B.T and Bahl, M 2017, ‘The influence of competition from informal firms on new product development’. Strategic Management Journal, vol. 38, no. 7, pp.1518-1535. https://doi.org/10.1002/smj.2585

Saha, A, Hock-Eam, L and Yeok, S.G 2018, ‘Deciphering drivers of efficiency of bank branches’. International Journal of Emerging Markets. https://doi.org/10.1108/IJoEM-11-2016-0301

Shaver, J.M 2006, ‘A paradox of synergy: Contagion and capacity effects in mergers and acquisitions’. Academy of Management review, vol. 31, no. 4, pp.962-976. https://doi.org/10.5465/amr.2006.22527468

van der Sluis, T, Arts, B, Kok, K, Bogers, M, Busck, A.G, Sepp, K, Loupa-Ramos, I, Pavlis, V, Geamana, N and Crouzat, E 2019, ‘Drivers of European landscape change: stakeholders’ perspectives through fuzzy cognitive mapping’. Landscape Research, vol. 44, no. 4, pp.458-476. https://doi.org/10.1080/01426397.2018.1446074

As mentioned earlier, our team of Assignment writers takes several measures to ensure that the writing is free from all forms of plagiarism.

We make a rigorous process to appoint Assignment helpers in our team. To ensure that we are hiring the best candidates for the team.

To ensure that you get a quick response on issues related to any order, we have installed a 24/7customer support system.

No matter which of your assignment writing helps you benefit from our experts, we always try to provide the necessary support within the promised time.

We never burden students with a lot of costs. We understand how difficult it is to manage financially.

At GlobalAssignmentexpert.com, we maintain a high standard for any writing in terms of their quality.